Iowa has a state income tax rate of 8%, making tax planning essential for high-income earners. For accredited investors, there are strategies to reduce tax liabilities, particularly through investments in real estate and oil and gas. Let’s explore these opportunities, focusing on depreciation benefits, passive income, and portfolio diversification.

Who Is an Accredited Investor?

An accredited investor is someone who meets specific financial criteria set by the U.S. Securities and Exchange Commission (SEC). These individuals or entities have access to investment opportunities not available to the general public, such as private placements in real estate and oil and gas. To qualify as an accredited investor, an individual must have:

- A net worth exceeding $1 million (excluding the value of the primary residence), or

- An annual income of at least $200,000 ($300,000 for joint income) for the past two years, with an expectation of earning the same or more in the current year.

As an accredited investor in Iowa, you can leverage these exclusive opportunities to not only grow your wealth but also reduce your taxable income.

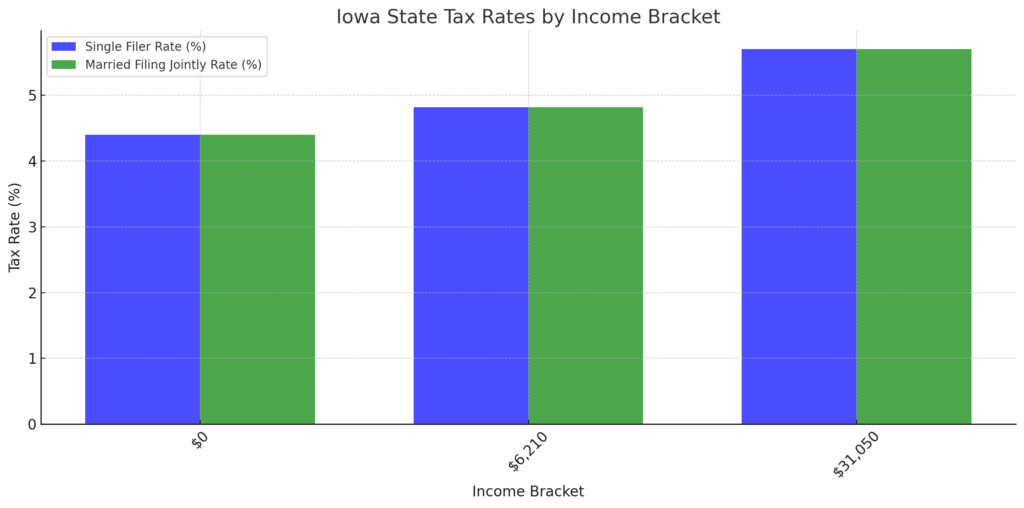

2024 Iowa State Income Tax Rates and Brackets

Iowa State Individual Income Tax Rates and Brackets, as of January 1, 2024

Pros and Cons of Real Estate Investments

Real estate is a popular investment vehicle for accredited investors, offering both tax benefits and long-term appreciation. In Iowa, property values tend to be more stable compared to some coastal states, making real estate a solid, long-term investment option. However, like any investment, real estate comes with its own set of challenges.

Tax Benefits of Real Estate

- Depreciation Deductions: One of the primary tax benefits of real estate investing is the ability to deduct depreciation on your properties. The IRS allows you to depreciate the value of the building (not the land) over 27.5 years for residential properties and 39 years for commercial properties. This depreciation can significantly reduce your taxable income.

For example, if you purchase a rental property for $500,000 and $400,000 of that is attributed to the building, you can deduct approximately $14,545 annually ($400,000 ÷ 27.5 years). This deduction can be a powerful tool for offsetting the income you generate from the property or other high-income sources.

- Mortgage Interest and Operating Expense Deductions: In addition to depreciation, you can also deduct mortgage interest and expenses related to maintaining the property. These expenses can include repairs, property management fees, insurance, and utilities, further reducing your taxable income.

Challenges of Real Estate Investing in Iowa

While real estate offers significant tax advantages, it also requires active management. For example, property owners must deal with tenants, maintenance, and repairs, which can be time-consuming and stressful. Additionally, in Iowa, where winters can be harsh, properties may require more frequent maintenance, adding to the overall cost and effort of property management.

For accredited investors who prefer a more hands-off approach, real estate syndications are a potential solution. Syndications allow you to pool your resources with other investors to purchase larger properties, such as commercial buildings or apartment complexes. These investments are managed by professional teams, allowing you to enjoy the tax benefits of real estate without the hassle of day-to-day management.

Oil and Gas Investment Benefits: Passive and Hands-Off

For accredited investors seeking a more passive investment with substantial tax benefits, oil and gas investments offer an attractive alternative. Unlike real estate, which requires active management, oil and gas investments generate passive income while offering significant tax deductions.

1. Intangible Drilling Costs (IDCs)

One of the primary tax benefits of oil and gas investments is the ability to deduct Intangible Drilling Costs (IDCs). These are the non-salvageable expenses associated with drilling a well, such as labor, chemicals, and fuel. IDCs typically make up 70-80% of the total cost of drilling and are fully deductible in the first year of the investment.

For example, if you invest $100,000 in an oil and gas project, you could potentially deduct $70,000 to $80,000 from your taxable income in the first year. This immediate tax benefit makes oil and gas an excellent option for high-income earners looking to reduce their Iowa state tax burden.

2. Tangible Drilling Costs (TDCs)

In addition to IDCs, investors can also deduct Tangible Drilling Costs (TDCs), which are the costs for physical equipment used in drilling, such as rigs and pipelines. These costs are depreciated over several years, providing ongoing tax benefits.

3. Depletion Allowance

Another significant tax benefit of oil and gas investments is the depletion allowance. This allows investors to recover the cost of the resource as it is extracted, similar to depreciation for real estate. The IRS offers both percentage depletion and cost depletion methods, allowing investors to choose the one that provides the greatest tax benefit.

4. Passive Income and Portfolio Diversification

Unlike real estate, which often requires active management, oil and gas investments generate passive income through royalties or the sale of oil and gas. This makes oil and gas an ideal option for accredited investors who want to enjoy tax benefits without the time and effort required to manage properties.

Additionally, oil and gas investments provide portfolio diversification, reducing your exposure to other market sectors like stocks and real estate. Energy markets often operate independently of broader economic trends, providing stability during times of market volatility.

Ready to Create a Wealth-Building Plan Tailored to You?

Visit IGTJ.com/invest to learn more about opportunities that help you offset taxes and grow wealth.

Diversifying for Stability and Cash Flow

For accredited investors in Iowa, diversification is key to managing risk and maintaining steady cash flow. While real estate and oil and gas investments offer significant tax benefits on their own, combining these investments can help create a more balanced portfolio.

1. Real Estate for Long-Term Appreciation

Real estate investments tend to appreciate over time, providing long-term growth potential. By holding real estate in your portfolio, you can benefit from both tax deductions and the eventual appreciation of the property. This makes real estate an excellent investment for accredited investors looking for both tax relief and long-term wealth accumulation.

2. Oil and Gas for Immediate Tax Benefits and Passive Income

Oil and gas investments, on the other hand, provide immediate tax benefits through IDCs and TDCs, as well as passive income from royalties. This makes oil and gas an attractive option for accredited investors who want to reduce their tax burden while generating a steady stream of cash flow.

By diversifying your portfolio with both real estate and oil and gas investments, you can enjoy the benefits of long-term appreciation, passive income, and significant tax savings. This combination provides stability, helping you weather market fluctuations while reducing your Iowa state tax liability.

Conclusion: Accredited Investor Solutions for Reducing Iowa State Taxes

Iowa’s 8% state income tax can be a challenge for high-income earners, but accredited investors have unique opportunities to offset their tax burden. By investing in real estate, you can take advantage of depreciation, mortgage interest deductions, and operating expense write-offs. However, real estate requires active management, which may not be ideal for every investor.

For those seeking a more passive investment, oil and gas offer significant tax benefits through IDCs, TDCs, and the depletion allowance. These investments also generate passive income, making them an excellent option for accredited investors looking to diversify their portfolios and reduce their taxable income.

By incorporating these strategies into your financial plan, you can reduce your Iowa state tax liability while continuing to grow your wealth.

Not ready to schedule a call yet?

Download our Oil and Gas Investment eBook to learn more about how these investments can work for you.